The role of the Chief Compliance Officers (CCOs)

The role of the Chief Compliance Officers (CCOs)

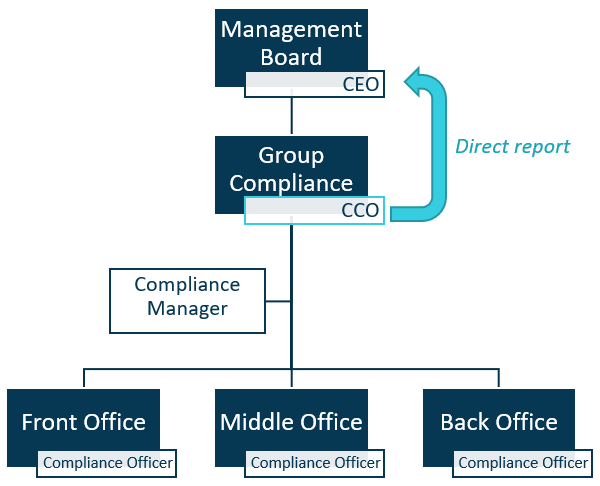

The CCOs, who are part of the management team, are responsible for the compliance of the organisation with the law, and the different policies and requirements. They ensure this compliance through the implementation of standards, good practices and process to efficiently identify and prevent non-compliance risks.

Directly reporting to the CEO, they guarantee the Board the effectiveness of their standards and procedures as well as their understanding and application by the employees.

- Monitoring the compliance program;

- Defining the normative perimeter of the organisation (laws, regulatory requirements, good practices, etc.);

- Coordinating the implementation of those regulations within the organisation;

- Checking and evaluating the efficiency and effectiveness of the compliance program;

- Providing strategic advice to the Management Team;

- Taking part into the decisional and strategic process of the organisation.

Main skills required:

- Knowledge in Finance, Accounting and Risk Analysis as well as about the jobs, products and services of the organisation;

- Expertise about the regulatory environment of the firm;

- Coordination and leading skills.

With the recent data regulations put in place - for example the MiFID II aiming at more trade transparency or the BCBS 239 towards the improvement of risk data aggregation and reporting across financial markets, - CCOs are more than ever a key stakeholder within the organisation.